Research Funding Impact on Startups and U.S. Economy

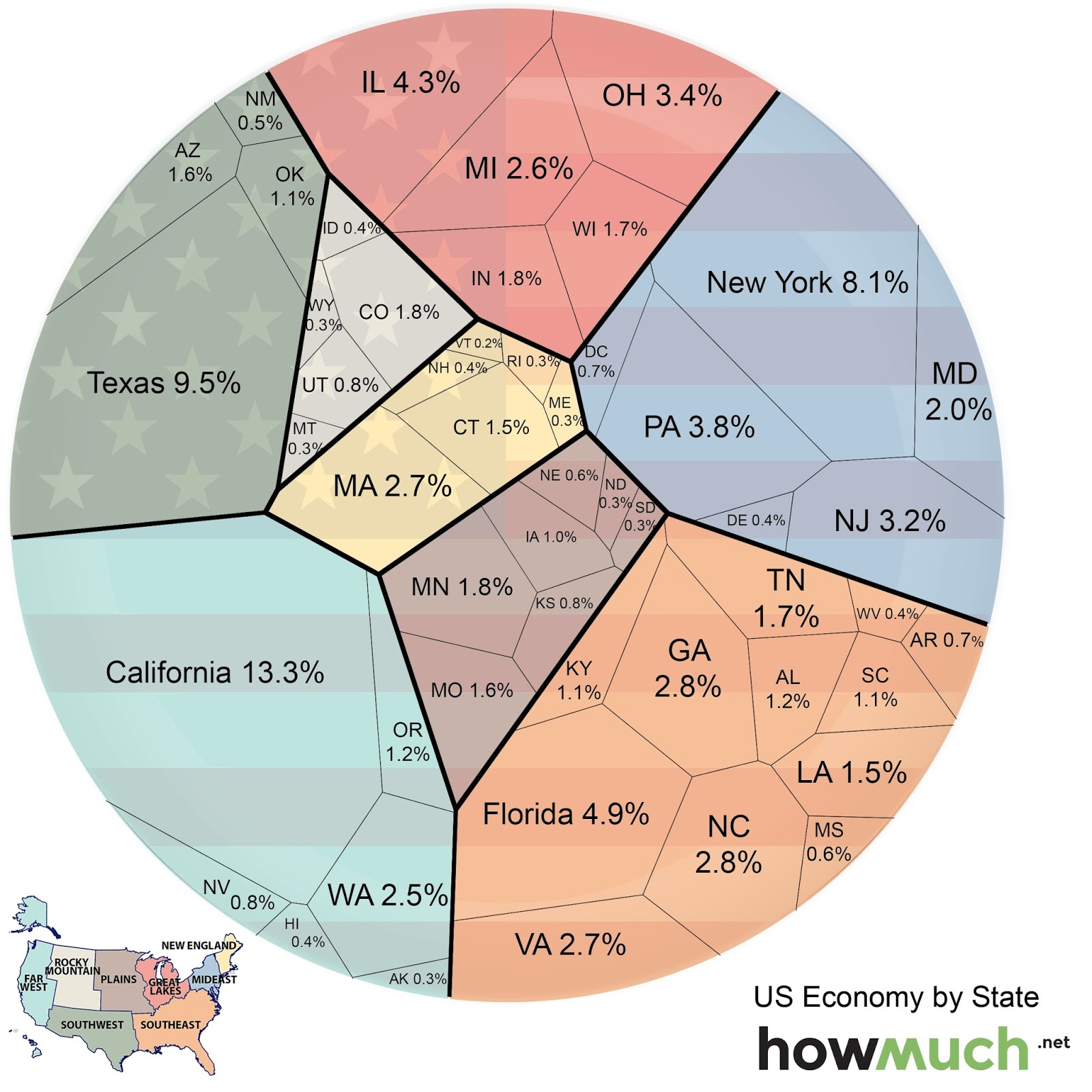

Research funding impact is a critical issue that resonates deeply within the realm of innovation and entrepreneurship growth in the U.S. economy. As federal funding streams face potential cuts, the consequences for research institutions like Harvard could stifle emerging scientific ventures vital for today’s knowledge-based economy. Without adequate financial support, the delicate balance of the startup ecosystem may falter, hindering the commercialization of groundbreaking ideas developed in laboratories. Moreover, economists warn that a significant reduction in research funding could lead to a staggering 3.8% decline in GDP, reminiscent of the 2008 recession. Clearly, the interplay between federal funding and the fostering of entrepreneurial spirit is indispensable for maintaining momentum in the drive for technological advancement.

The influence of financial support on research initiatives is pivotal for sustaining innovation and fostering economic expansion. This support not only empowers universities to conduct critical studies but also promotes the formation of new ventures within the startup landscape. With the backing of public funding, research institutions can cultivate entrepreneurial talent and pave the way for advancements that enrich both community and industry. Such funding acts as a catalyst that propels scientific discovery into the realm of viable business opportunities, effectively contributing to the overall health of the national economy. Understanding this dynamic is essential for recognizing how a robust funding environment can stimulate growth and development in our entrepreneurial sectors.

The Role of Federal Funding in Research and Innovation

Federal funding plays a pivotal role in the landscape of research and innovation in the United States. Institutions like Harvard leverage these funds to drive groundbreaking research that not only advances academic knowledge but also fosters economic development. The U.S. economy heavily relies on the outputs generated from federally funded research, as seen in the impressive return on investment ratios reported by various analyses, such as the $2.56 in economic activity for every dollar invested in federal biomedical research. This influx of resources enables universities to maintain state-of-the-art laboratories, hire top-tier faculty, and attract ambitious students, all of which contribute to a vibrant innovation ecosystem.

The importance of federal research funding cannot be overstated. Strong federal backing facilitates long-term research projects that are crucial for technological advancements in fields such as medicine, engineering, and environmental science. In light of the recent cuts and the ongoing freeze on research grants, there is growing concern over the potential stagnation of innovation within the U.S. Realizing the substantial economic benefits derived from research initiatives, it is clear that fostering federal funding is essential to maintain the country’s competitive edge in the global market.

Impact of Research Funding Freeze on the Startup Ecosystem

The recent freeze on research funding at prestigious institutions like Harvard poses a severe threat to the startup ecosystem that thrives on innovation derived from academic research. Startups often emerge from research breakthroughs, with new technologies being commercialized and turned into businesses that contribute to entrepreneurship growth. A lack of accessible federal funding inhibits the development of new ideas and limits the ability of researchers to translate their findings into viable commercial applications. Without ample resources, the pipeline that fuels new company creation is jeopardized, which could severely stunt growth in sectors critical to the U.S. economy.

Moreover, the effects of this funding freeze extend beyond immediate financial implications; they may reshape the entrepreneurial landscape for years to come. Many startups currently in incubation at universities have been relying on past funding to produce innovative products and services. The disruption in funding means fewer resources for developing these ideas, leading to potential delays in launching new ventures. If emerging entrepreneurs are unable to access the support they need, we risk losing a generation of innovative minds that could have invigorated the American economy through new startups.

Investment in Education: A Catalyst for Startups

Investment in education, particularly through programs that foster entrepreneurship within research universities, can catalyze the growth of startups and support a thriving economy. Harvard, recognized for its robust entrepreneurship curriculum, educates students on how to navigate the complexities of turning innovative ideas into successful companies. By emphasizing practical experience and real-world application of business principles, educational institutions serve as breeding grounds for the new generation of entrepreneurs. This ecosystem not only emboldens students but also provides them with a framework for launching viable startups that could positively influence the broader U.S. economy.

The ongoing partnership between research institutions and the startup community is essential for nurturing talented individuals who will become economic leaders. Programs like business incubators, accelerator partnerships, and mentorship opportunities help create a seamless transition from ideation in classroom settings to real-world entrepreneurship. As universities continue to integrate entrepreneurship into their curricula, the potential for innovation and economic growth becomes ever more promising, particularly in a climate where funding sources may fluctuate. This investment in education is vital for ensuring future prosperity in the startup space.

Entrepreneurship Growth: Lessons from Harvard

Harvard’s strong emphasis on entrepreneurship offers valuable lessons for other universities and institutions seeking to stimulate innovation and economic growth. The combination of a well-rounded educational foundation and access to extensive research resources empowers students to explore and capitalize on their entrepreneurial ambitions. For many aspiring entrepreneurs, the presence of seasoned faculty and industry experts provides critical insights that can transform initial ideas into sustainable business models. This structured approach has been instrumental in fostering a culture of entrepreneurship at Harvard, making it one of the premier institutions for startup cultivation.

Additionally, the connection between academia and the industry is vital for driving real-world applications of research. Successful startups emerging from Harvard demonstrate the potential for collaborative partnerships that culminate in technological advancements serving society at large. Such collaboration not only enhances the educational experience for students but also enriches the overall startup ecosystem, contributing significantly to national economic resilience and growth. By sharing the effective strategies employed at Harvard, other institutions can strive to replicate this success, thus enriching the network of innovation across the country.

Long-Term Economic Consequences of Funding Cuts

The long-term economic consequences of funding cuts to research are worrisome, especially when considering the potential ripple effect on the startup ecosystem. As outlined by current analyses, even modest reductions in federal funding could lead to a contraction in the gross domestic product comparable to past economic downturns. Startups are often seen as engines of job creation and economic revitalization, and their capacity to emerge and thrive is directly linked to the availability of research funding. Without sufficient grants, the innovation pipeline becomes strained and the future of numerous entrepreneurial ventures hangs in the balance.

Moreover, the implications of these funding cuts extend beyond the immediate disruption of existing research projects. Delayed innovations may result in fewer competitive products and services making their way to market, ultimately hindering the U.S. economy’s growth. Entrepreneurs rely on the robust foundation provided by research funding to innovate and develop solutions that address pressing societal challenges. As long-term funding cuts continue, we risk stifling the creativity and ingenuity that have historically positioned the U.S. as a leader in technology and innovation.

Building Resilience in the Face of Funding Challenges

Building resilience within the research and startup ecosystems in response to funding challenges is crucial for sustaining innovation. This involves diversifying funding sources and exploring alternative avenues for support beyond federal grants. By forming partnerships with private investors, venture capitalists, and philanthropic organizations, research institutions can create a more sustainable financial model that can withstand political uncertainties. Such strategic collaboration not only increases funding availability but also provides valuable industry insights that can help shape projects into commercially viable ventures.

Additionally, fostering a culture of innovation is essential for overcoming challenges associated with funding cuts. Educational institutions can focus on developing adaptive strategies that encourage researchers and entrepreneurs to pivot when faced with limitations on resources. By cultivating an entrepreneurial mindset that embraces flexibility and resilience, universities can empower innovators to seek alternative solutions and avenues for growth. This proactive approach will better equip the startup ecosystem to navigate future uncertainties, ensuring continued contributions to the U.S. economy.

The Future of Science and Innovation at Research Universities

The future of science and innovation at research universities is intricately tied to the stability of funding sources, particularly federal research grants. As the landscape of funding evolves, universities must adapt to ensure that they remain at the forefront of innovation. This involves investing in infrastructure that supports both research and entrepreneurship, such as creating federal, state, and local partnerships that enhance funding opportunities. The ability for research universities to respond and adapt to these changes will determine their capacity to influence future technological advancements and economic development.

Furthermore, maintaining a robust pipeline for talent is essential for fostering innovation in the years to come. Research universities have a responsibility to ensure that they continue to attract and retain promising scientists, engineers, and entrepreneurs. This can be achieved by enhancing educational programs that emphasize interdisciplinary collaboration and innovation, as well as establishing mentorship programs that connect students with industry leaders. By prioritizing the development of future innovators, universities will help safeguard the U.S. economy against the possible repercussions of funding uncertainties while reinforcing their critical role in the global research landscape.

The Interconnection Between Research Funding and Economic Growth

Understanding the interconnection between research funding and economic growth is vital in today’s rapidly changing landscape. Economic prosperity is often rooted in the ability of institutions to innovate, and research funding serves as a primary catalyst for such advancements. The current fiscal challenges highlight the necessity of a robust funding ecosystem to ensure that groundbreaking ideas can transition from conception to commercialization. Federal funding, in particular, acts as a linchpin that connects universities with newly emerging startups, creating a cycle of innovation that ultimately benefits the economy at large.

Moreover, enhanced federal engagement in research funding can facilitate the development of a more competitive global marketplace. By enabling high-quality research and fostering an environment conducive to entrepreneurship, the U.S. can maintain its leadership position in technology and innovation. As universities navigate these complexities, a renewed focus on strategic partnerships and funding diversification can help align academic success with broader economic objectives. This interrelationship between research funding and economic growth underscores the critical need for a coordinated effort to secure and sustain support for research initiatives, ensuring a brighter economic future for all.

Frequently Asked Questions

What is the impact of federal funding on research and innovation in the U.S. economy?

Federal funding plays a crucial role in driving research and innovation in the U.S. economy. It supports scientific research that leads to technological advancements and fosters entrepreneurship growth. Studies have shown that for every dollar invested in federal biomedical research, there is a return of approximately $2.56 in economic activity, highlighting the importance of federal funding in creating jobs and nurturing startups.

How does research funding affect the startup ecosystem in the U.S.?

Research funding directly influences the startup ecosystem by providing resources that enable universities to conduct cutting-edge research. This research often leads to the commercialization of breakthrough technologies, serving as a catalyst for entrepreneurship growth. Universities with robust funding can attract talent and investors, thereby enhancing the startup landscape and contributing to economic development.

What role does Harvard innovation play in the advancement of entrepreneurship?

Harvard innovation is pivotal in advancing entrepreneurship due to its strong focus on commercialization pathways from research. The university’s significant federal funding enables it to maintain leading research facilities, such as the Wyss Institute. This creates an environment where aspiring entrepreneurs can develop ideas that have real-world applications, ultimately fueling the startup ecosystem and impacting the U.S. economy.

How does a freeze on federal research funding impact entrepreneurship growth?

A freeze on federal research funding can severely hinder entrepreneurship growth by limiting the resources available for research and innovation. Without critical funding, universities may face hiring freezes and grant cancellations, leading to a reduction in the number of startups emerging from academic institutions. This disruption jeopardizes the pipeline of new ideas and technologies essential for economic progress.

In what ways can cuts to research funding threaten U.S. economic growth?

Cuts to research funding threaten U.S. economic growth by stifacing innovation and reducing the availability of new technologies. According to expert analyses, projected decreases in funding could lead to a GDP shrinkage similar to the repercussions experienced during the 2008-2009 recession. A compromised research landscape limits the potential for developing highly successful companies that contribute to the economy.

What are the long-term effects of reduced federal funding on entrepreneurship and innovation?

The long-term effects of reduced federal funding on entrepreneurship and innovation include a slowdown in the development of new startups and technologies. As funding decreases, innovative research becomes limited, resulting in fewer commercialized ideas. This trend can perpetuate a cycle where the U.S. falls behind in global competitiveness and technological advancements, impacting overall economic growth.

How does Harvard’s approach to research impact the commercialization of scientific innovations?

Harvard’s approach to research significantly impacts the commercialization of scientific innovations by fostering a structured environment that encourages faculty and students to transform ideas into viable businesses. Through dedicated resources like technology licensing offices and partnerships with venture capitalists, Harvard catalyzes new startups and contributes to the vibrant startup ecosystem crucial for U.S. economic health.

What are the implications of stalled federal grants on scientific research and entrepreneurship?

Stalled federal grants impede scientific research and entrepreneurship by disrupting the flow of resources critical for innovation. This can lead to hiring freezes, canceled research initiatives, and longer timelines for developing commercially viable products. The effects may not be immediate, but they will likely manifest in the form of fewer startups and limited economic dynamism in the subsequent years.

| Key Point | Description |

|---|---|

| Government Funding Freeze | Harvard University faced a freeze of over $2 billion in research grants due to government demands, threatening more than $9 billion in potential funding. |

| Impact on GDP | Funding cuts could lead to a 3.8% contraction in GDP, comparable to the 2008-2009 recession according to research from American University. |

| Role of Research Universities | Research universities play a critical role in entrepreneurship, both through faculty creating commercial applications from research and students launching startups. |

| Federal Funding Importance | Federal funding is essential for maintaining well-resourced labs that foster innovation and attract top talent, driving economic growth. |

| Long-Term Effects | The impact of funding freezes will manifest in the medium to long-term, potentially reducing the number of successful startups. |

Summary

The impact of research funding on innovation is profound and cannot be overstated. Research funding impact determines the vitality of the startup ecosystem in the U.S., serving as a critical foundation for economic growth and technological advancement. The current funding freeze is likely to stifle innovation, leading to fewer successful startups emerging from research institutions. As the effects of these funding cuts unfold over time, it will be crucial for policy makers to recognize and act upon the importance of stable research investment to safeguard the future of U.S. entrepreneurship.